As Cathay Pacific looked to slash its costs, Cathay Dragon was axed. The subsidiary airline was fully integrated into the Cathay Pacific group in 2006 and finally rebranded as Cathay Dragon in November 2016, seemingly finalizing its assimilation into the group and firmly showcasing its importance. But what went wrong?

The Hong Kong-based Cathay has long suffered a crisis of its own. In 2019, the company was in the final year of its transformation program which was due to return it to stable profitability. The first half of the year went smoothly – Cathay Pacific managed to net a profit and increase revenues. The airline managed to achieve something that was usually not attributed to it – a healthy first half of the year. But in March 2019, the Hong Kong protests began, including the eruption of activity in the summer of 2019.

“The protests in Hong Kong reduced inbound passenger traffic in July and are adversely impacting forward bookings,” the now-ousted chairman of Cathay Pacific John Slosar stated in August 2020, as the airline announced its H1 2019 results.

Second half of the year for the 74-year-old airline went as smoothly as it could, considering the backdrop of the civil rights movement. Despite the circumstances, it ended the year with an annual profit of HK$1.6 billion ($206.3 million), split into an H1 profit of HK$1.3 billion ($167 million) and an H2 profit of HK$344 million ($44.3 million). But the profit was largely the result of the group’s subsidiaries. The two airlines of the company, namely Cathay Pacific and Cathay Dragon, ended the year with a net profit of HK$241 million ($31 million).

Shrinking Dragon

The two airlines had to cut flights due to the dwindling demand across almost all their networks and Asia in particular. Cathay Dragon was forced to reduce capacity to Shanghai Pudong International Airport (PVG) by 21 weekly flights and cut down on frequencies to Beijing, Taipei Seoul, and Osaka, including the suspension of flights to Tokyo Haneda Airport (HND), Denpasar in Bali for the winter season, and Medan, Indonesia indefinitely.

In November 2019, the Cathay group indicated that half of the 32 Airbus A321neo order would go to HK Express, a low-cost carrier subsidiary acquired in July 2019. The only impending new aircraft that remained attributed to the Dragon was the 16 A321neos, despite its 48 aircraft fleet clocking in at an average of 15.3 years of age. 28 of those were outright owned by the airline, including 11 Airbus A330-300s owned by Cathay Pacific and leased to the subsidiary. The other 20 were leased under an operating lease, indicating that Cathay Dragon was only renting the aircraft from lessors outside the group, per se.

Those developments did not indicate a happy future for Cathay Dragon – with an aging fleet and barely any new orders on the horizon, including the group’s clear interest to invest in HK Express, the sun was seemingly setting in front of the mythical creature’s eyes.

Yet it was not always this way. The airline played a very crucial role in Cathay Pacific’s goal to remain a dominant force in Asia-Pacific in the mid-2000s, and especially to rebuff the pressure coming from mainland China.

Changes up North

China’s aviation market was under a very tight grip on the Civil Aviation Administration of China (CAAC). The pricing, frequencies, routes, even who was eligible to fly on aircraft. Starting in the 1980s, changes had become apparent and the country’s aviation market began to slowly shift away from its centrally planned model, much like the country itself. Opportunities were there, and Cathay wanted to expand.

The late-1980s saw the establishment of China’s largest airlines, namely Air China, China Eastern Airlines (CIAH) (CEA), and China Southern Airlines (ZNH), including several other carriers that were later merged into the Big Three of China. Slowly but surely, the Big Three had started to become formidable forces not only domestically, but internationally as well. For instance, China Southern Airlines (ZNH) is now one of the biggest airlines in the world.

Upon signing the Sino-British Joint Declaration in December 1984 regarding Hong Kong’s future under China after July 1, 1997, the agreement outlined that Hong Kong would maintain its status as “a center of international and regional aviation.” With the ever-growing Chinese airlines, the reality was a bit different. Traffic was growing in China, and Cathay Pacific wanted a piece of that pie.

After all, the pie was set to grow massively. In a 2000 General Market Forecast (GMF) prepared by Airbus, China’s domestic market was set to grow “nearly five-fold, at an average annual rate of 8.1 percent per year.” The second-largest market in terms of its growth was the China – Asia market, with a growth rate of 7.5%. Yet Cathay Pacific was never a major player in China. Upon the establishment of Dragonair in 1985, the latter became the number one Hong Kong-China connector. Five years down the line, Cathay acquired a 35% stake in its local rival.

With that acquisition, actors started playing their roles.

Cathay Dragon role

The green-liveried airline faced another growing problem. In January 1998, it tried to address the issue by combining individual route groups into one network management team. The move had to help it to increase transfer traffic, according to Cathay Pacific’s 1998 financial report. Its focus started shifting towards transfer traffic.

“This revenue stream has been particularly important in the past year as the number of passengers traveling to Hong Kong, as a final destination, declined sharply.”

Throughout 1998, it pulled capacity out of North Asia, reducing the Available Seat Kilometers (ASK) by 4.1% compared to 1997. In comparison, the Pacific and South African market saw ASKs grow by a whopping 14.4%. The airline, for example, introduced a new daily frequency to Sydney Airport (SYD), in order to develop the Europe to Australian market. Despite on paper competing against two giants in their home markets, namely British Airways and Qantas, Cathay Pacific actually benefited from expansion – as the oneworld alliance was established in February 1999, the competition turned into an enhanced offering for passengers.

“Load factors of the Australia and New Zealand routes were low and yields suffered, especially on the Auckland service. Improvements are anticipated in 1999. oneworld alliance benefits are also anticipated in the region,” the Hong Kong airline concluded.

So, Cathay Pacific was trying out a new tune to dance to. Cathay Dragon, then still known as Dragonair, was just raising the volume of its own song. The carrier increased capacity across its mainland China-focused network by 9%. And while the 1997 financial crisis in Asia hit the whole region, “the performance of Dragonair remains satisfactory as the China market, the backbone of the company’s operation, has been affected to a smaller extent than other markets in the region,” concluded Cathay’s financial report.

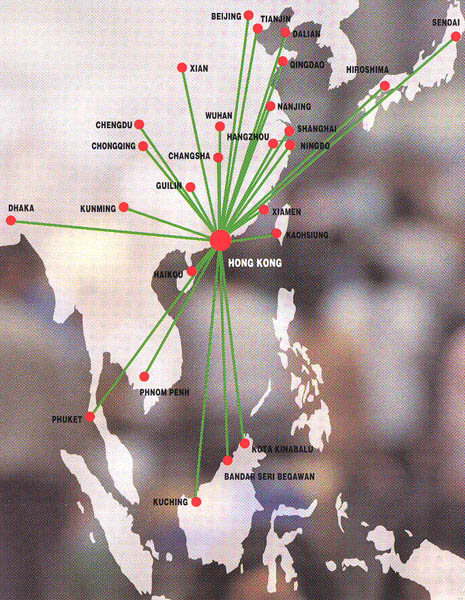

Dragonair route map in 1997. Image source: Chris Sloan

Dragonair was included in the report under “affiliated Businesses and associated companies,” despite the fact that Cathay Pacific now held a 19% stake in the airline. Seemingly, its importance to the group, especially in the backdrop of it concentrating on transfer traffic, was only growing.

Cathay Pacific’s own flights to China were not. In 2000, when Hong Kong and China signed a new Air Services Agreement, it was Dragonair whose routes were upgraded from charters to scheduled flights. The regional airline was granted the right to sell tickets and cargo services in a number of Chinese cities, a key step to further attract even more passengers.

“Management of Dragonair is optimistic about the future of the airline,” Cathay Pacific concluded in its annual report in 2000.

The group’s realization that its business associate was important never diminished.

From Dragonair to Cathay Dragon

The importance of Dragonair was only growing and finally, in 2006, the airline was almost-fully integrated into the group.

In June 2006, Cathay Pacific bought out 100% of Dragonair’s shares for a total of HK$8.2 billion ($1.06 billion), after a complex negotiation procedure that involved a mainland-based carrier Air China. In addition to the newly acquired Dragonair, Cathay Pacific also doubled its stake in Air China, increasing it to 20%. In return, the Chinese airline bought a 10% share package in the Hong Kong-based carrier.

At the time, Cathay Pacific had only two routes into mainland China, namely Beijing and Xiamen. The newly-acquired Dragonair added 23 destinations that connected Hong Kong with its northern neighbor, providing a robust and strong network for its HKG hub. Overall, Dragonair repositioned itself to put more emphasis on its mainland China routes in 2006. While its ASKs grew to North Asia by 7.3%, the airline retreated from its routes in South-east Asia and the Middle East, reducing capacity there by 15%. Despite the discrepancy between the growth one way and shrink the other, Dragonair increased its total capacity by 5.4% compared to 2005. All in all, it deployed 10.6 billion ASK and averaged a load factor of 67.8%.

In 2016, the integration process was seemingly finally completed as the carrier dropped its old name and was now known as Cathay Dragon. The year was difficult for the group, as its profit plummeted from 2015’s result of HK$6 billion ($774 million) to a loss of HK$575 million ($74.1 million). In March 2017, as the company presented its 2016 results, Cathay Pacific introduced its three-year corporate transformation program. While a HK$575 million ($74.1 million) loss is not the end of the world, the devil was hidden in the details. Cathay’s airlines, Pacific and Dragon, lost HK$3.3 billion ($425 million), which was offset by a HK$2.7 billion ($348.3) share of profit from its subsidiaries and associates.

However, Changes in Dragonair began much sooner. In January 2016, the group announced that the airline would now be named Cathay Dragon in order to “capitalize on Cathay Pacific’s high international brand recognition and leverage on Cathay Dragon’s unique connectivity into Mainland China,” read the company’s press release.

Four years down the line, Cathay Pacific’s chief executive Augustus Tang had little to share about the news that the Dragon was now beheaded and its operations consolidated into the main airline:

“Over its 35 years, Cathay Dragon has earned a well-deserved reputation for excellence, thanks to its outstanding service and distinct hospitality, delivered by a remarkable team,” stated Tang.