Reports and rumors about the financial difficulties at the British regional carrier Flybe prompted some interesting reactions. Some were questioning why was this happening, as just a few months ago, Virgin Atlantic-led consortium Connect Airways announced a rebranding of the carrier to Virgin Connect to better align with the Virgin (VAH) family. Others were questioning whether the British government should be involved in rescuing the allegedly ailing airline as Flybe is crucial to regional connectivity within the United Kingdom.

International Airlines Group (IAG) (IAG), meanwhile, complained directly to the European Union regarding the state aid to the struggling company.

British Airlines Pilots Association (BALPA) was “appalled” that talks were held behind closed doors without involving the people working at the airline. BALPA further added that Flybe “plays an incredibly important role connecting the regions and nations of the UK and onwards to Europe” and if it were to close its doors, a new Flybe would have to be invented, stated the pilot union.

Nevertheless, the company lives on to see another day. On January 14, 2020, the British Government announced official measures “to support and enhance regional connectivity across the UK,” according to press release by Her Majesty’s Treasury. Measures include looking at the Air Passenger Duty (APD) tax, which taxes each economy class passenger departing from British airports $16.9 (£13), meaning a domestic passenger pays twice the sum, putting a heavy burden on Flybe’s competitiveness against other means of travel. Another move to save the regional carrier would be to defer a $130 million (£100 million) tax bill for up to three years, allowing the company to restructure its business and avoid potential downturns in the future.

But why is Flybe so important to the United Kingdom and its connectivity? How come with the backing of Virgin Atlantic, the carrier is struggling once again? And finally, what are some of the factors that might have led to the potential demise of the regional airline?

Flybe connections around the United Kingdom

Flybe’s main role is connecting some of the smaller airports on the British Isles to hubs and bigger cities in Europe, including the UK’s own London-Heathrow (LHR) or Manchester Airport (MAN), for example.

Exeter Airport (EXT) is one of the carrier’s bases, where Flybe currently accounts for 70% of total traffic. The regional carrier is the only airline serving such cities as Amsterdam (AMS), Paris-Charles De Gaulle (CDG) and Manchester (MAN). Most of the other destinations, served by other airlines during the winter schedule, including Ryanair and TUI Airways, are leisure destinations. In 2019, Exeter Airport saw 934,000 passengers crossing its gates, according to the UK’s Civil Aviation Authority (CAA) data as of November 30, 2019.

Another example is Belfast (BHD), where Flybe is one of only five airlines serving the airport with a 66% market share. The 3 million passenger airport, named after George Best, would potentially lose flights to Birmingham (BHX), London-City (LCY) and Manchester (MAN). The three named cities are also some of the most popular routes out of Belfast (BHD), making up for a total of 40.4% weekly flights out of the Northern Irish capital.

Southampton Airport (SOU) would possibly suffer the most: with Flybe carrying over 90% of the total capacity out of the 2 million passenger airport, the bankruptcy of the regional airline would potentially leave the airport deserted until a replacement carrier would come in.

Judging by the data, there is a clear indication that several airports in the United Kingdom would lose crucial connectivity to the outside world, including domestic routes within the Isles and airports located on islands outside mainland Britain.

The backing of Virgin Atlantic

Just over a year ago, on January 11, 2019, news broke out that a Virgin Atlantic-led consortium Connect Airways, including Stobart Aviation (a franchise partner of Flybe) and Cyrus Capital Partners, purchased the airline that was on the verge of bankruptcy. It seemed like with the backing of Connect Airways consortium, the company’s woes were over. Not only they received funding to continue operations, but the buyout greatly benefited Virgin Atlantic too. The airline got itself a domestic partner without investing too much into acquiring crucial slots and aircraft to serve those slots.

And after an announcement on October 16, 2019, it seemed like Flybe’s future was secured: the regional airline will end 2020 being Virgin Connect.

“As part of the extended Virgin (VAH) family, Virgin Connect will reflect the innovation and entrepreneurship of Virgin (VAH) ‘s wider brands, putting our customers first and offering better value,” stated Virgin Atlantic’s press release at the time.

Yet just three months later, news broke out that once again, the company was struggling and was potentially on the verge of closing down. A resolution was found fairly quickly. Chairman of Connect Airways, Lucien Farrell said that the consortium made its commitment to keep Flybe going with additional funding and Government initiatives.

Possibly, Connect Airways used Boris Johnson’s “leveling up” promises to their own advantage to lobby against the Air Passenger Duty tax by combining the fact that Flybe is primarily based in various regions and is severely hindered by the tax. In short, Johnson’s policy means that the Conservative party aims to boost the economic levels of Britain’s regions so that it would match the performance of London.

“But what we will do is ensure we have the regional connectivity that this country needs. That is part of our agenda of uniting and leveling up,” Johnson told BBC Breakfast on January 14, 2020, regarding Flybe’s woes. Politically, over 2,400 people losing their jobs if the company were to fold would be a nightmare for the prime minister who had promised to take care of the well-being of the country’s regions, including its connectivity.

Yet Johnson has the problem of juggling another ball: those who oppose flying and its environmental impact.

The fall of domestic air travel within UK

In 2007, over 22 million passengers traveled on domestic routes on airlines registered in Britain. However, the number has been on a free fall ever since – in 2018, there were 21.2 million domestic travelers, the highest number since 2007. Yet 2019 brought another headache to the aviation industry: flight shaming.

In September 2019, Heathrow Pause planned to protest against the airport’s expansion, citing environmental concerns. The protestors wanted to use drones, which would have stopped Heathrow (LHR) operations. However, citing signal jamming, the protest never truly took off.

In October 2019, Extinction Rebellion tried to halt operations at London City Airport (LCY). The protest included James Brown, a former British Paralympian, climbing on top of a British Airways aircraft inside the airport. Another man, who got onboard a flight to Dublin to directly speak to the passengers, attempted to discourage them from flying.

Paralympian James Brown is on top of a British Airways plane on the runway at City Airport as part of @ExtinctionR protests. pic.twitter.com/OysdT3wRKu

— Catrin Nye (@CatrinNye) October 10, 2019

Furthermore, rail usage has been on the rise in the United Kingdom. Data presented by the British Department for Transport indicates that on average, in 2018/2019, the number of passenger journeys increased by 3%. While domestic air travel has been falling since 2007, rail usage has been on the rise for the same period of time, the Office of Rail and Road (ORR) indicates. ORR data also showcases that amount of journeys onboard Regional trains has grown by 7.4% in Q2 2019-2020 compared to Q2 in the corresponding period in 2018-2019. Such growth was last seen in Q4 2011-2012, possibly hinting at the fact that travelers are now more likely to choose train travel rather than fly on domestic routes.

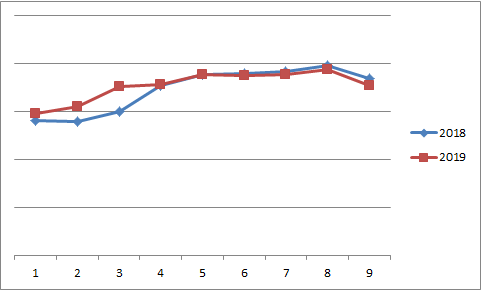

The British CAA is yet to release its 2019 full-year data. However, preliminary trends indicate that domestic travel is falling compared to 2018, especially in the second part of the year:

Comparison of Domestic passenger numbers in the United Kingdom between the first nine months of 2018 and 2019. Data by UK’s CAA, image by Rytis Beresnevicius.

Nevertheless, the saving grace for Flybe might become the fact that Virgin Atlantic is aligning the regional carrier towards its own operations. The British airline is on a quest to take down British Airways’ dominance in Heathrow and other parts of the country. Ensuring it can strengthen its hubs with regional passengers is essential for Virgin Atlantic for it to be able to come face to face with British Airways and truly become the second flag carrier of Britain, as, according to the former, Britain deserves better.