The race to shore up the industry’s global pilot personnel is at the forefront of airlines’ main operational and scheduling issues.

Air travel has rebounded in North America, faster than any other region. However, this burgeoning return has illuminated a precarious shortage of airline pilots further exacerbated by a wave of pilot early retirements.

US-based management firm, Oliver Wyman, estimates that North America is short of 8,000 pilots or the equivalent of 11% of the needed pilot supply.

In its pilot demand outlook, Canada-based simulation technology manufacturer CAE predicts that North America will need 65,000 new pilots in the next 10 years, while Oliver Wyman predicts that North America will be short nearly 30,000 pilots by the end of the same period.

So, while a wave of disruptions, cancellations and airline schedule adjustments grip the industry, how have US airlines responded to this increased demand for pilots?

Airlines roll out waves of pay incentives, but who has the best upgrades?

With mounting pressure from pilot unions, as well as staffing shortages prior to the start of summer 2022, US airlines were backed into a corner with no option but to offer incentives and bonus upgrades to their personnel and pilot remuneration packages in a bid to retain and attract staff.

These changes were seen across regional, legacy and low-cost airlines in the US market.

In January 2022, Avelo Airlines, a US low-cost carrier (LLC), announced improved pilot compensation packages which consisted of elevating the first year pay for captains by nearly 50% and by nearly 30% for first officers.

Utah-based Breeze Airways also announced pay raises, while regional carriers Piedmont Airlines and Envoy Air (American Airlines’ (A1G) (AAL) subsidiaries) hiked pilots’ pay by 50% through to August 2024.

In June 2022, PSA Airlines, another AA subsidiary, announced a compensation package that made the airline’s pilot group the highest paid in the regional airline industry.

“Regardless of what the airlines are saying, there is no pilot shortage and there are more than enough certificated pilots to meet demand here in the United States” - Federal Aviation Administration

PSA stated that its pilots will earn 50-70% more (57% on average) than the next highest-paid regional carrier, Endeavor, and can expect to earn 10% more over the next five years against pilots at leading LCCs, ULCCs, and cargo carriers.

In August 2022, the Air Line Pilots Association (ALPA) confirmed an agreement consisting of an hourly rate of pay increase of nearly 118% for first-year captains and 172% for new-hire first officers of Mesa Airlines, an Arizona-based regional airline.

The pilots of Florida-based ultra-low-cost carrier Spirit Airlines (S64) (SAVE) are also seeking upgrades to their employment contracts. Contract negotiations with Spirit management were scheduled to begin on September 6, 2022.

Legacy US airlines

In June 2022, United Airlines was one of the first major US airlines to offer a pay raise for its pilots, negotiating a tentative deal for a 14.5% pay increase within 18 months. The deal was expected to be ratified by July 15, 2022. However, a week later, American Airlines (A1G) (AAL) (AA) put forward its own pay offer for its pilots, which included a base pay increase of 17% and other enhanced payments.

According to American Airlines’ (A1G) (AAL) CEO Robert Isom, a narrowbody captain at the top of the scale would earn about $340,000 a year – $45,000 more each year than they earn today, and a widebody captain at top of the scale would earn about $425,000 a year, or $64,000 more annually.

AA’s more attractive deal prompted United’s pilots to reconsider their own tentative contract agreement with United Airlines, according to the United Airlines Master Executive Council (MEC), a representative body of United Airlines pilots.

Captain Mike Hamilton, chair of the United MEC, part of ALPA, said in July that United Airlines’ management agreed to reengage in discussions for a new and improved agreement. This will likely add some months to the final agreement vote as United’s pilot union will poll its members on how to improve the old agreement.

And, in August 2022, the Allied Pilots Association (APA), representing up to 15,000 American Airlines (A1G) (AAL) pilots, sought a 20.4% pay increase over three years, according to the union’s new president Ed Sicher.

In mid-August 2022, Sicher told Forbes that he expects AA to accept its elevated proposal, saying that it’s in management’s interest to get a deal within the next 30-60 days to achieve reliable scheduling before the fall and winter vacation periods.

Delta Air Lines offered nearly all its employees a 4% raise from May 1, 2022, according to an internal memo from Delta’s CEO, Ed Bastian.

Can partnerships save the pilot pipeline?

While negotiations for better pay packages are still ongoing for some US airlines, other airlines are shoring up their pilot pipelines through partnerships with airlines and training schools.

In March 2022, Southwest Airlines (LUV) partnered with SkyWest Airlines and Advanced Airlines as part of Southwest’s ‘Destination 225°’ program.

“The ability to attract pilots to Southwest via the partnerships with Advanced Airlines and SkyWest Airlines will bolster our opportunity to develop highly-skilled candidates for First Officer roles at Southwest Airlines (LUV),” said Alan Kasher, Southwest’s senior vice president of air operations.

Meanwhile, in an agreement with the Air Line Pilots Association (ALPA), representing more than 65,000 pilots at 40 US and Canadian airlines, PSA Airlines committed to streamlining its pilots through to the American Airlines Group within five years, adding that it will “compensate any eligible pilot who is not offered a position at American by the end of their fifth year of service at the top of the captain pay scale”.

But is there really a pilot shortage?

In a blog, United Airlines CEO Scott Kirby identified three factors in an effort to debunk the so-called myths of the pilot crisis.

Kirby said that the shortage in pilots predates COVID-19, the “pilot shortage” is not driven by pay or benefits, and the “shortage” is not the result of any mass exodus of workers.

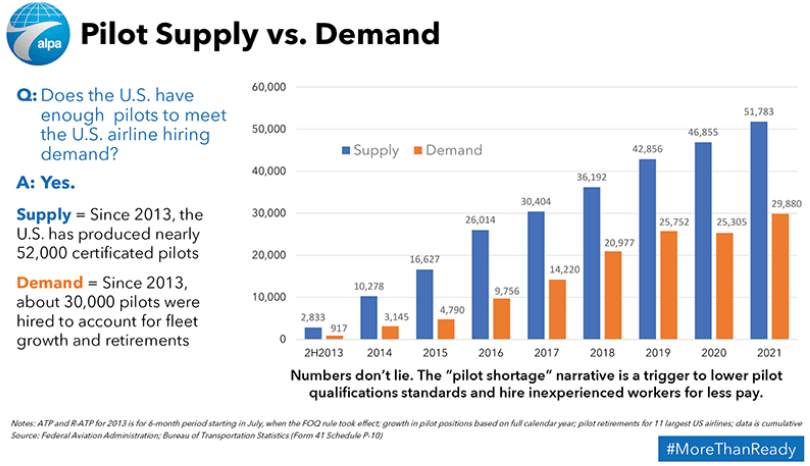

Air Line Pilots Association: Pilot Supply vs Demand, cumulative data

Source: Federal Aviation Administration and Bureau of Labor Statistics data

However, in the long term, Boeing’s outlook estimates that 602,000 newly qualified pilots will be required over the next 20 years, with North America accounting for 21% (128,000) of the total – the largest share.

While the narrative at the forefront of the industry’s pilot discussion points towards a shortage, the Federal Aviation Administration (FAA) challenges that notion stating that “there is no pilot shortage”.

According to data collated by the FAA and Bureau of Labor Statistics, there are currently about 1.5 certificated pilots relative to demand.

According to an ALPA report, the FAA stated: “Regardless of what the airlines are saying, there is no pilot shortage and there are more than enough certificated pilots to meet demand here in the United States. The aviation industry is currently producing more pilots capable of immediately stepping into the right seat than there are jobs available to them.”