René Armas Maes is an international consultant specializing in airline and business aviation restructuring, strategic planning, revenue optimization, and cost reduction.

René began his career as a Senior Analyst at Simat, Helliesen & Eichner in New York City, where he advised global airlines, airports, regional aviation operators, and business aviation clients. Today, he collaborates with airlines, business aviation operators, and airports worldwide, serving as an instructor for IATA and ACI in airline and airport management. He also holds an MBA from the John Molson School of Business in Montreal, Canada.

The views and opinions expressed in this column are solely those of the author and do not necessarily reflect the official policy or position of AeroTime.

Understanding the size, structure, and evolution of the UAE–UK business jet charter corridor requires proxies that are both empirically observable and economically meaningful. Direct visibility into charter demand, pricing, and utilization remains constrained by confidentiality and market fragmentation. In this context, scheduled airline first and business class seat capacity, including Etihad’s Apartment and Residence First Class products, provides a powerful analytical anchor.

Premium airline travelers share core characteristics with business jet charter clients, including high willingness to pay, time sensitivity, and concentration in global financial centers. While not all premium passengers are charter candidates, premium airline capacity establishes a measurable upper bound on the addressable high-value travel market.

Premium airline absorption vs. business aviation airport usage

In absolute terms, premium seats from the UAE to the UK reached 611,851 in 2023, 675,346 in 2024, and 674,916 in 2025, implying 5.0% compound annual growth rate (CAGR) and confirming the UK as the most important European premium destination for UAE-origin travelers. This conclusion only becomes evident when the UK is assessed as an integrated airport system, encompassing not only London Heathrow (LHR) and Gatwick (LGW) but also Manchester (MAN), Stansted (STN), Birmingham (BHX), Glasgow (GLA), Newcastle (NCL), and Edinburgh (EDI).

This distributed absorption pattern mirrors business aviation behavior, where demand is dispersed across multiple airports rather than concentrated solely at a single hub. For example, business aviation traffic favoring London Luton (LTN), Farnborough, Biggin Hill, Stansted, Manchester, Birmingham, and Edinburgh airports that align geographically and functionally with the same premium catchment areas served by airlines. This distributed absorption supports treating premium airline data as an external map of where high-value demand sits, even if business aviation uses different airports.

Crucially, key UK business aviation airports such as London Luton, Farnborough, and Biggin Hill have no direct analogue in airline premium data because they are not scheduled hubs, yet they sit immediately adjacent to Heathrow’s premium demand basin. This reinforces the proxy logic: airline premium capacity identifies where high-value demand exists, while business aviation reallocates that demand toward airports optimized for flexibility, availability, and time efficiency.

Similarly, regional premium airline absorption at Manchester, Birmingham, and Edinburgh also aligns closely with business aviation usage. These airports serve financial services, energy, government, and industrial demand – the same sectors that drive long-range charter activity to and from the UAE – confirming that premium airline data captures the economic geography of demand even if it does not reflect the operational choice of airport.

From an analytical standpoint, regional premium absorption matters because it identifies where high-value demand exists beyond the primary hub, mirrors business aviation’s distributed operating pattern, and highlights structural charter demand that is less constrained by slot limitations at airports like Heathrow. In market sizing, it strengthens the proxy value of airline data by revealing the economic geography of premium travel demand, even when operational airport choices differ between scheduled airlines and business aviation.

Heathrow as a structural anchor in the UAE-Europe premium corridor

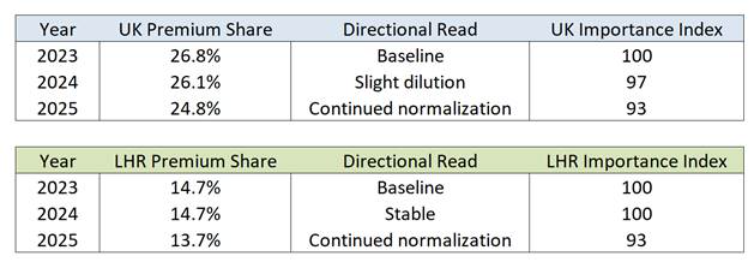

When analyzed consistently across all airports, the data shows that the United Kingdom absorbed between 24.8% and 26.8% of all UAE-to-Europe premium airline capacity from 2023 to 2025, averaging approximately 25.9% over the period. Within this concentrated UK share, Heathrow alone accounted for an average of 14.4% of all UAE-to-Europe premium seats, making it the single most important destination airport in the corridor, as illustrated by Chart A.

Chart A: Premium Share reflects UK system-level absorption and Heathrow’s share of UAE–Europe premium seats, indexed to 2023=100. Directional read reflects normalization, not loss of structural importance. Data: OAG

Moreover, Heathrow accounts for more than half of all UAE–UK premium capacity, capturing between 54.8% and 56.4% of premium seats over the three years. The persistence of this concentration reinforces that the UAE–UK corridor is structurally anchored rather than cyclical or opportunistic, positioning Heathrow as a core premium demand axis within the broader European network rather than a marginal market.

For business jet analysis, this reinforces Heathrow’s role as a reliable proxy for high-value, time-sensitive travel behavior. This level of concentration at one of the world’s most slot-constrained airports is highly relevant to business aviation, as congestion, limited peak-hour availability, and schedule inflexibility create structural conditions that encourage substitution toward business jets, especially for time-critical and last-minute travel.

Seasonality alignment between premium seats and business aviation

Seasonality patterns further reinforce the proxy. While absolute volumes differ, the timing of demand is directionally consistent, supporting premium airline traffic as a behavioral proxy rather than a volume substitute.

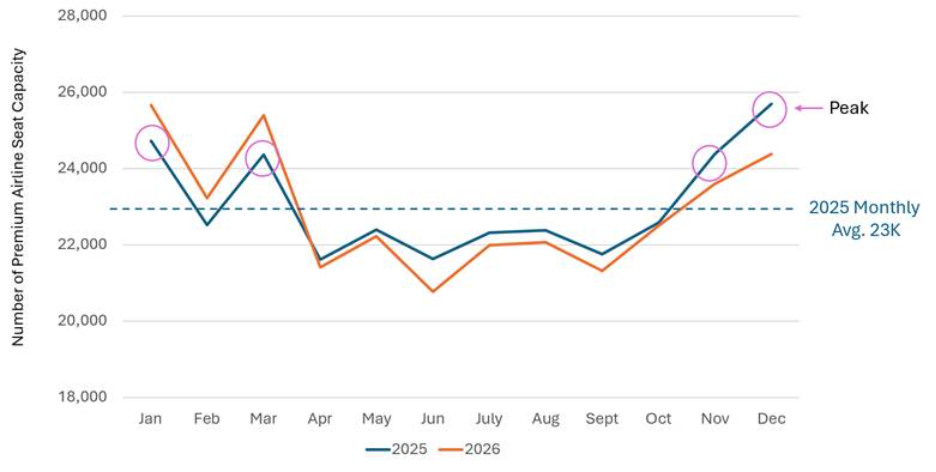

As illustrated by Chart B (DXB/AUH to LHR for 2025, with 2026 scheduled capacity shown for directional reference), airline premium capacity typically softens in February, accelerates through the spring, and strengthens toward year-end showing distinct premium airline capacity peaks.

Chart B: First and Business Class seat capacity. DXB/AUH to LHR for 2025 with 2026 scheduled capacity shown for directional reference. Data: OAG

Business jet activity may peak differently, particularly during the European summer, which is precisely why an overlay is required. This hypothesis should be validated using observed monthly business jet movements or flight hours for the same corridor to assess seasonal alignment. A close alignment across both segments would suggest they respond to the same underlying drivers, including executive travel cycles, family mobility during school holidays, and the seasonal concentration of corporate, sporting, and leisure events.

What the proxy does and does not represent

It is important to clarify the role of premium airline capacity within this framework. It is not a forecast of business jet demand, nor does it imply a direct conversion between airline passengers and charter flights; rather, it serves as a constraint and plausibility anchor. If implied charter utilization or revenue growth diverges materially from premium airline trends without a clear structural explanation, that divergence warrants scrutiny.

For this reason, the proxy is intended to constrain corridor-level market size, not to explain individual charter booking behavior. While premium airline traffic does not capture ultra-high-net-worth privacy preferences, point-to-point flexibility, or last-minute charter behavior, it provides a statistically robust signal of where premium demand concentrates, how it evolves, and how it scales over time.

Conclusion

First and business class seat capacity serves as a supply-side signal of where airlines allocate premium inventory and when persistent over time, reflects where premium demand is structurally anchored. As such, it provides a strong and defensible proxy for analyzing the UAE–UK business jet corridor, capturing the same high-value travel ecosystem, reflecting real-world congestion and substitution dynamics, and aligning geographically with charter fleet basing and demand.

The data used in this analysis confirms the UK’s structural importance within Europe, highlights Heathrow as a critical pressure point, and provides a transparent, independently verifiable anchor for triangulating business aviation market size. While premium airline seat capacity can be influenced by airline network decisions and does not directly measure realized demand or yields, its value lies in assessing concentration and seasonality patterns.

When used in this way and triangulated with charter flight activity alongside rate-based, cost-plus, and movements-based models, premium airline seat capacity enhances analytical rigor while reducing the risk of over- or underestimating true business jet charter market potential.