Beginning as a small propeller repair shop for general aviation, APS was established near Chicago in 1953. It grew to eventually become one of the few independent operators licensed by Collins Aerospace to service some of the world’s most advanced turboprop propellers, emerging as a key player in the MRO turboprop space.

“It’s a business founded by technical people,” said Ezequiel de Souza Junior, Executive Director of APS Brazil. “We have built a reputation for excellence since the beginning over seven decades ago.”

AeroTime spoke with De Souza to learn how the Brazilian operation has played a pivotal role in the international growth of APS. Over the last few years, it has seen its business grow in the Americas and established itself in Asia for the first time.

Although it had been in the turboprop MRO and overhaul business for decades, the big leap for APS came in 2013 when the long-time owners sold to a new equity group. This was followed by the opening of a brand-new facility in Lake Zurich, Illinois in 2015, and the expansion of its license to perform MRO services for UTC Aerospace Systems, an aerospace manufacturer that subsequently acquired another industry giant, Rockwell Collins, to form Collins Aerospace.

The next logical step for APS was to leverage its highly specialized capabilities through international expansion. This opportunity presented itself in 2016, when UTC decided to leave Brazil and APS acquired its partner’s overhaul and service center in Atibaia, Sao Paulo state.

“It was a great opportunity for APS,” De Souza explained. “Initially this unit was to serve mainly Azul, since this airline is the largest operator of ATR turboprops in Latin America.”

ATR turboprops, both the ATR-42 and ATR-72 models in their different versions, use the 568F propellers made by Collins Aerospace. The repair and overhaul of this type of propeller is one of APS’ core capabilities.

The acquisition of the Brazilian plant also provided APS with the chance to combine pre-existent local capabilities with those found at its headquarters in the United States.

By 2019, APS Brazil had grown to the point of profitability when the COVID-19 pandemic struck.

“Azul informed us that they were grounding all planes,” said De Souza, who had just joined APS in January 2020. “This was potentially devastating for us, since we were very dependent on the airline market at the time and there were no government support schemes available in our region at all.”

However, the pandemic provided an opportunity for the successful growth and diversification strategy that the company implemented in record time.

Under pressure to find new sources of revenue, APS made a push for the defense sector, which accounted for 25% of its business in Brazil by the end of 2020 compared to barely 10% the preceding year.

The defense business has managed to keep its share of APS’ revenue after the pandemic, while the airline segment almost halved, from 61% pre-pandemic to the current 33%.

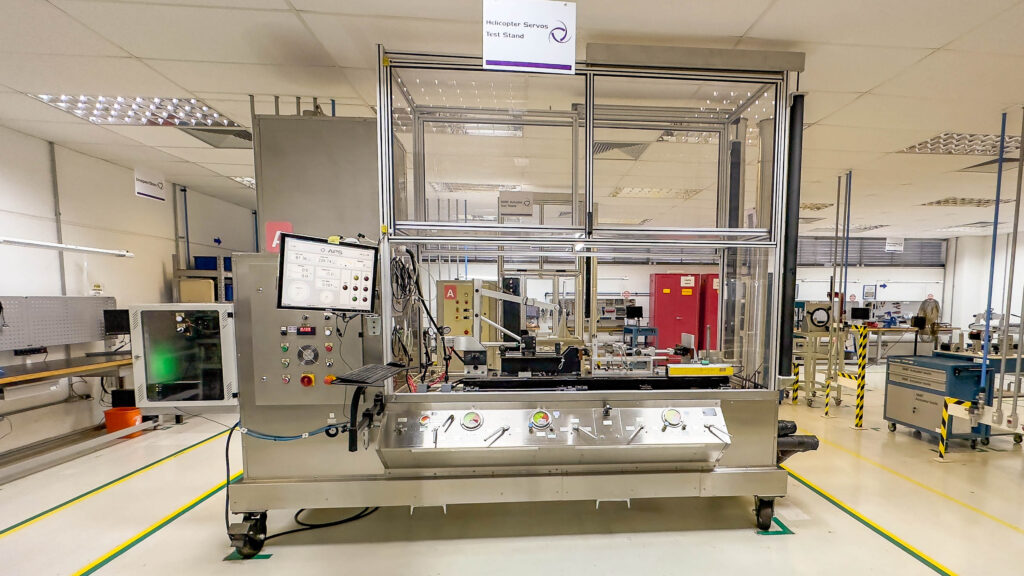

APS Brazil has also experienced growth in the helicopter industry, with Sao Paulo being the largest market for private helicopters worldwide.

APS has been present in this market since 2017, when it began to service helicopter actuators for both the main and tail rotors, and it has since grown to represent approximately a third of their revenue.

The rest of APS Brazil’s revenue corresponds to what the firm labels “special services” – a mix of services it provides to third parties, including other MRO shops.

Having the Collins Aerospace license, and previous expertise in overhauling civilian turboprops, was essential in APS getting on board with the military, since the Airbus CN-295 light transport aircraft operated by the Brazilian Air Force uses the same type of propeller as the ATR regional airliner.

De Souza is particularly proud of APS’ work for the Brazilian Air Force.

“In 2020, about half of their CN-295 fleet was usually grounded at any one time due to technical issues,” he explained. “And, by the end of 2021, all of their 10 aircraft, the whole fleet, was back up in the air.”

De Souza added that this aircraft type was used extensively by the Brazilian military in 2020 and 2021 to bring supplies to communities around the country that had become stranded due to pandemic-related transport disruptions.

Not only did APS Brazil manage to keep its entire staff throughout the pandemic, but it emerged as a more resilient business, ready to play an even greater role within the broader APS group.

As a result, the success of the Brazilian operation has served as a blueprint for other APS centers.

De Souza explained how, for example, some of the lessons acquired in Brazil will be replicated at the MRO shop APS is opening in Kuala Lumpur, Malaysia, where it will service ATR and Airbus turboprops for Malaysian Airlines and other operators in the region.

De Souza also highlighted how in the near future the Malaysian shop could expand into helicopters, a promising growth market in Asia.

“APS is working as a global team to produce better results,” explained De Souza while referring to how the information flows between the different APS shops.

The Malaysian team, for example, also helped to identify potential improvements in the Brazil shop.

De Souza also mentioned how, in 2023, APS Brazil hosted a large corporate event attended by teams from the United States and Malaysia, which boosted the coordination between the different regional units.

“When you have good people involved you can get lots of results,” he stated.

As with APS Brazil, De Souza identified some avenues for further growth, both vertically and horizontally across the sector. An obvious one is to enter adjacent markets throughout Latin America.

De Souza said he counts on APS’ close relationship with Collins Aerospace and, through it, with ATR and Airbus, to gain new customers for the company.

“Since 2008 OEMs have focused more on the aftermarket and today is a huge business for them,” he explained. “They want to keep it in their hands, and it has become more difficult for independent players to get access to their technologies.”

He continued: “The fact that APS is a trusted partner confers us an advantage because it is important to be able to access certain technologies. You need a license because it is intellectual property.”

De Souza also referred to how specific processes can only be performed by an authorized operator like APS. He offered an example of the juncture between the composite blades and the metal root of the propeller, which is a critical point and only the OEM or a licensee can touch it.

“For this, it is essential to have a relationship with the OEM. We could perform these tasks in other Latin American countries, since the OEM, Collins Aerospace in this case, trusts us,” he explained, adding that APS also has several other country certifications.

APS also has some other lines of business. It manufactures some small and medium parts in-house and it also trades parts and spares in the aftermarket, sometimes stripping serviceable parts from aircraft that are being withdrawn from service. It also offers technical training to third parties.

“All these businesses have the same hallmark,” De Souza said. “In addition to the amazing technical expertise of our team, we are very driven by customer satisfaction and take turnaround times for our customers very seriously.”

“These have been the core tenets that have defined APS for more than 70 years,” he concluded.