René Armas Maes is an international consultant specializing in airline and business aviation restructuring, strategic planning, revenue optimization, and cost reduction.

René began his career as a Senior Analyst at Simat, Helliesen & Eichner in New York City, where he advised global airlines, airports, regional aviation operators, and business aviation clients. Today, he collaborates with airlines, business aviation operators, and airports worldwide, serving as an instructor for IATA and ACI in airline and airport management. He also holds an MBA from the John Molson School of Business in Montreal, Canada.

This is a co-authored article in collaboration with Andreas Velmachos, Senior Engineer and Managing Partner at an engineering firm supporting lessors, ACMI operators and airlines.

The views and opinions expressed in this column are solely those of the author and do not necessarily reflect the official policy or position of AeroTime.

Engine transitions have become a critical value inflection point in commercial aviation. As ownership consolidates with lessors and aircraft move more frequently between operators, jurisdictions, and maintenance regimes, engines now concentrate disproportionate technical, financial, and operational risk. Valuation data shows that engines can represent over half of a narrowbody’s total aircraft value, meaning even minor gaps in records or work scope can trigger significant cost overruns, downtime, and asset devaluation.

Traditional, reactive approaches to engine transitions are no longer sufficient. What is required is an engineering-led Continuing Airworthiness Management Organisation (CAMO) consultancy model that governs engine condition, records, and work scope across the full lifecycle, not just at shop induction or redelivery. Embedded technical oversight shifts engine transitions from reactive problem-solving to a proactive risk management model.

When executed well, this approach delivers what matters most: tighter cost control through scope discipline, improved availability via shorter turn times and fewer surprises, and asset value protection through verified compliance and traceability. In today’s high-churn leasing environment, engineering-led engine transition management is no longer optional; it is fundamental to sustainable portfolio and financial performance.

Engine transitions: a strategic perspective

Whether triggered by lease expiry, operator change, repossession, or fleet restructuring, an engine transition compresses technical, regulatory, and commercial risk into a short window. Engines were once managed as long-term assets in stable operating environments, but that assumption no longer holds. Today, engines move more frequently across operators, jurisdictions, and MROs, increasing uncertainty around configuration, life-limited parts (LLP) traceability, compliance status, and remaining life at each transition.

Most engine transition failures are not caused by major technical defects, but by governance gaps: inaccurate status assumptions, incomplete back-to-birth records, misaligned shop work scopes, uncontrolled piece-part exposure, delayed approvals, and weak acceptance documentation. These issues drive cost overruns, and delays are the result of insufficient engineering oversight. As a result, CAMO consultancy and independent technical advisory support have become essential to control cost, protect availability, and preserve asset value.

In this environment, CAMO consultancy adds value by governing the technical and compliance framework around the engine. Independent engineering oversight establishes a verified baseline through LLP audits, Airworthiness Directives (ADs) and Service Bulletins (SBs) compliance checks, configuration validation, and review of historical shop-visit data. This replaces assumptions with facts and enables informed decisions before shop induction, when costs and risk escalate most rapidly.

Not all engine transitions require a full technical reset; many simply need a scope precisely aligned with lease return conditions and next-operator requirements. In addition, piece-part exposure is the largest source of cost volatility during engine shop visits. These findings emerge late, are hard to forecast, and involve high-value components where repair or replacement decisions can add hundreds of thousands of dollars. Without disciplined engineering governance, this exposure drives uncontrolled overruns, extended downtime, and weakened asset returns. CAMO consultancy ensures mandatory work is clearly separated from optional or discretionary tasks, preventing scope creep and misaligned capital spend. Moreover, a structured technical consultancy approach can introduce repair-versus-replace logic, exposure thresholds, and escalation rules that convert open-ended shop visits into controlled decision processes.

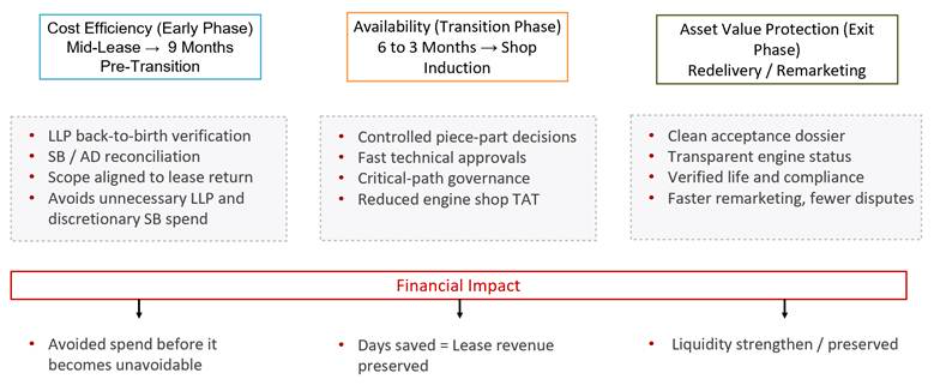

Turnaround time is often attributed to MRO performance, but in practice it is more frequently driven by delayed approvals, unclear decision authority, and incomplete documentation. Engineering-led oversight enforces disciplined decision cycles, critical-path control, and early material positioning, consistently reducing avoidable delays. At the back end, CAMO consultancy strengthens acceptance and redelivery through verified traceability, clear engine status statements, and documented deviations directly supporting the three value pillars of cost efficiency, availability, and accelerated remarketing with preserved asset liquidity, as illustrated in Chart 1.

Business case: Converting engine transition risk into predictable asset returns

A mid-life narrowbody approaching lease expiry presented a familiar but high-risk scenario for the asset owner. Redelivery was scheduled within nine months, with a follow-on lease conditionally agreed. While the airframe appeared compliant, early review showed the engines carried material uncertainty.

Although operator-provided data indicated compliance with return conditions, an independent engineering-led CAMO review uncovered latent risks: incomplete LLP back-to-birth trace, inconsistent SB records, and ambiguity around prior shop-visit scope. Left unresolved, these gaps would likely have surfaced late in the transition, when timelines are compressed, and leverage is limited.

The lessor implemented early technical governance. A verified engine baseline was established through trace audits, configuration validation, and reconciliation of historical shop data. The work scope was then aligned strictly with lease return and next-lessee requirements, avoiding unnecessary LLP replacement and discretionary SBs. During the shop visit, predefined repair-versus-replace logic and exposure thresholds-controlled scope growth, keeping the final invoice within a narrow variance band.

The outcome was tangible: US$280,000 in avoided engine spend, a 10-day reduction in transition downtime preserving lease-on revenue, and engines delivered with clean documentation and clear acceptance status. The result combined cost efficiency, improved availability, and protected asset value through disciplined, engineering-led transition management.

Conclusion

Engine transitions sit at the crossroads of engineering, finance, and operations. In a market defined by high asset mobility, regulatory complexity, and cost pressure, unmanaged transitions expose airlines and lessors to outsized risk. The evidence is clear: most transition failures are not technical inevitabilities, but governance failures.

An engineering-led CAMO consultancy and technical advisory model provides the structure, discipline, and foresight needed to control this risk. As leasing, ACMI, and asset-backed investment continue to scale, this approach is no longer optional. It has become the foundation of asset protection, operational resilience, and long-term financial performance, especially given that engines are the single most valuable component of a narrowbody aircraft and the largest cost driver over its lifecycle.