René Armas Maes is an international consultant specializing in airline and business aviation restructuring, strategic planning, revenue optimization, and cost reduction.

René began his career as a Senior Analyst at Simat, Helliesen & Eichner in New York City, where he advised global airlines, airports, regional aviation operators, and business aviation clients. Today, he collaborates with airlines, business aviation operators, and airports worldwide, serving as an instructor for IATA and ACI in airline and airport management. He also holds an MBA from the John Molson School of Business in Montreal, Canada.

The views and opinions expressed in this column are solely those of the author and do not necessarily reflect the official policy or position of AeroTime.

Over the last five decades, the airline industry has shifted from government-backed national carriers purchasing their own aircraft, to a competitive, privately financed global market where flexibility, liquidity, and fleet agility are essential.

Aircraft leasing has grown from less than 10% of the fleet in the 1970s to nearly 60% today, driven by airlines’ need for capital-light models, access to fuel-efficient aircraft (airlines largest or second-largest cost driver), simpler cross-border financing, and reduced residual-value risk.

Today, lessors supported by sophisticated financing structures and global reach provide much of the industry’s fleet backbone. This structural shift, however, has introduced new challenges and heightened technical risk as aircraft transfer between operators more frequently.

Why lessors need engineering-led oversight

Today, aircraft cycle more rapidly between operators and across continents, subject to varying maintenance practices and regulatory regimes. Each transfer raises the risk of discrepancies including missing records, undocumented repairs, misaligned AMP tasks, incomplete SB/AD status, inconsistent engine documentation, and cabin or structural issues that often surface late in the transition process. In this environment, engineering-led oversight is no longer optional; it is now central to asset protection, operational continuity, and financial performance for lessors.

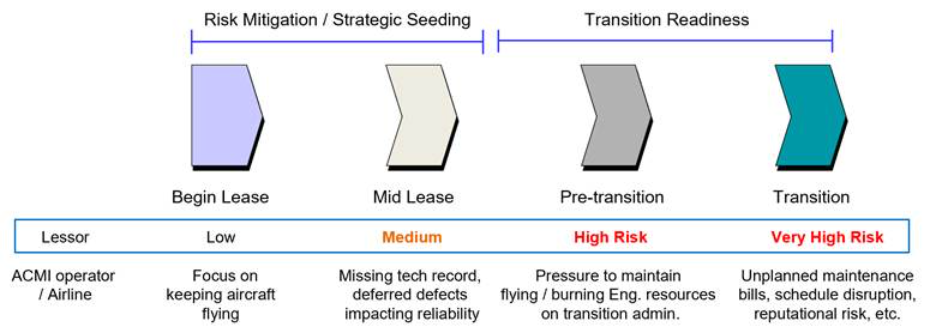

The old assumption that airlines and ACMI operators manage technical integrity while lessors focus solely on finance no longer applies. As portfolios grow and transition velocity increases, lessors must take a more active technical role. Engineering-led oversight provides the structured and proactive framework needed to identify risks early rather than inherit them at redelivery, as illustrated in Chart A.

For lessors, the redelivery timeline highlights the critical importance of protecting asset value and ensuring remarketing readiness. Transition risk increases sharply as redelivery nears, with the highest exposure occurring in the final nine to 12 months of the lease.

An early‑intervention model reduces risk for lessors

To reduce risk, financial exposure and improve transition predictability, a combined technical consultancy and CAMO support model is essential. Continuous monitoring of asset condition throughout the lease ensures that deviations, record gaps, and maintenance inconsistencies are addressed early, long before they escalate into costly redelivery disputes or delayed transitions.

For example, an integrated CAM and lease-transition management solution can streamline the most complex phase of the lease cycle: the transition window. Redeliveries can fail for numerous reasons, including missing records, undocumented repairs, MRO overruns, or late findings. Delays of 10 to 30 days are common and can cost lessors US$10,000 to US$20,000 per day in lost narrowbody lease revenue. Early-readiness audits, AD/SB validation, records-integrity work, and coordinated project management aligned with lessor manuals are therefore critical. Combining CAMO compliance with strong engineering capability ensures predictable transitions, accurate documentation, and contract-compliant redelivery.

Now, let’s consider maintenance-event oversight and contractor auditing. Using CAMO support model, it can mitigate one of the least predictable exposure points for lessors. Without strict control, MROs may add tasks outside lease conditions or overlook critical inspections. Through on-site or remote monitoring, daily progress reviews, work-scope validation, and contractor audits, lessors gain assurance of both work quality and cost alignment.

In addition, operational complexity further strengthens the need for engineering-driven support. Aircraft now move frequently between the European Union Aviation Safety Agency (EASA), Federal Aviation Administration (FAA), 2-REG, and other regulatory environments each with differing expectations. Repairs acceptable in one jurisdiction may require substantiation or rework in another. In the case of engines, which account for 50% to 75% of total aircraft value, they can add another layer of complexity with varying shop-visit standards and parts-traceability requirements. Without expert oversight, lessors face meaningful value degradation and remarketing delays impacting their cash flows.

Furthermore, an engineering-led oversight model also preserves technical continuity across multiple operators. As aircraft transition between lessees, critical knowledge is often lost, including root-cause analyses, structural-repair rationales, engine shop-visit history, reliability actions, and more. Centralized engineering oversight can maintain this continuity, enabling faster due diligence, more accurate forecasting, and smoother aircraft transitions.

A high-level business case illustrates the magnitude of value created. Consider a mid‑life narrowbody aircraft preparing for redelivery with a follow‑on lease already secured. Prior to technical consultancy and CAMO support model involvement, near 200 documents were incomplete, two repairs were undocumented, and the planned heavy check was inadequately scoped. Through a detailed gap analysis, re‑validated AD/SB compliance, and corrected planning data, results included US$160,000 in avoided records reconstruction, US$130,000 in late‑finding avoidance, US$100,000n MRO overrun reduction, and US$72,000 in added value by recovering six days of aircraft transition time. Therefore, the total benefit achieved reached US$462,000. With an engagement cost of ~ US$85,000, the net benefit reached is US$377,000 yielding a 4.4x ROI, or US$4.40 returned for every US$1 invested.

Financially, the value proposition is clear: engineering oversight reduces maintenance overruns, limits findings, prevents unnecessary work-scope expansion, accelerates aircraft transitions, protects aircraft residual value, and strengthens remarketing readiness for lessors.

Conclusion

Today, aircraft move between operators faster than ever due to ACMI growth, short-term operating contracts, and high fleet churn in the low-cost carrier and wet lease markets. Yet key risks persist including documentation quality varying widely by operator, engineering maturity differing across regions, MRO auditing is inconsistent, back-to-birth traceability is often incomplete, and structural repairs accumulate with weak historical traceability. However, unfortunately technical-control mechanisms have not evolved at the same pace, creating an expanding engineering-oversight gap for lessors that directly affects transition timelines and lease economics.

A structured consultancy and CAMO support model closes this gap by providing continuous oversight across the entire lease cycle, not just at redelivery. And this approach strengthens the three pillars essential to lessor performance: greater cost efficiency, improved operational reliability, and optimized asset-value protection for long-term commercial success.

This is a co-authored article in collaboration with Andreas Velmachos, Senior Engineer and Managing Partner at an engineering firm supporting lessors, ACMI operators, and airlines.